45L tax credit software & services for energy efficient homes

The home builder and Home Energy Rater source for 45L tax credit solutions with U.S. Department of Energy approved Micropas 45L software.

IMPORTANT NOTE – This website may be used to qualify residential buildings that were built and sold before December 31, 2022. Any home built and acquired on or after January 1, 2023, must be certified to ENERGY STAR. Please contact us for more details.

A federal incentive for energy efficiency

The 45L Energy Efficient Home Credit offers builders & developers a $2,000 federal tax credit per energy efficient home

$2,000 per qualified home Single family and multi-family projects up to three stories including condos, apartments, assisted living, and student housing can qualify.

Home Builders & Developers The entity that financed the project construction claims the $2,000 per home federal tax credit.

Retroactive for 3 years Builders can claim the tax credit retroactively for up to 3 years.

Focused on results

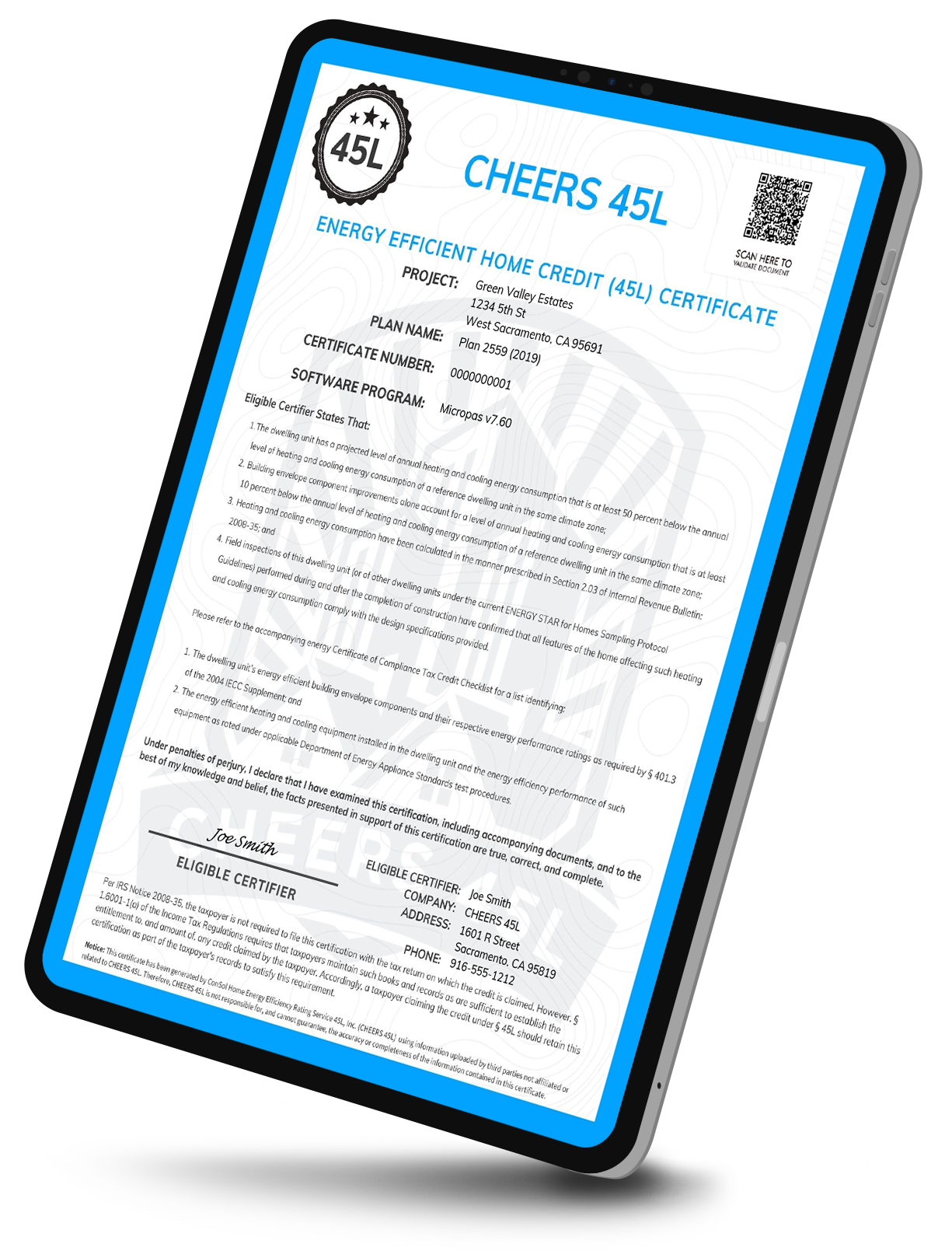

45L tax credit solutions to meet your needs

Flexible options to pursue 45L tax credit certificate documentation:

Self-Service We provide web-based access to DOE approved Micropas 45L tax credit software at no cost. Import energy files and model your projects to see if they qualify. Generate 45L certificates instantly.

Full-Service A turn-key approach where our expert team of energy modelers collect project energy specifications, model your project in DOE approved software, and provide you the 45L certificate documentation required to take the credit.

45L service for businesses of all sizes.

Newsletter Signup

Subscribe to our newsletter and stay up-to-date with CHEERS 45L news!